How do I Merge Funds in Balance?

There is a Merge Funds feature available in Balance that will automatically create system-generated transactions to move the historical gift and market value balances of the merged/closed fund to another fund.

Notes

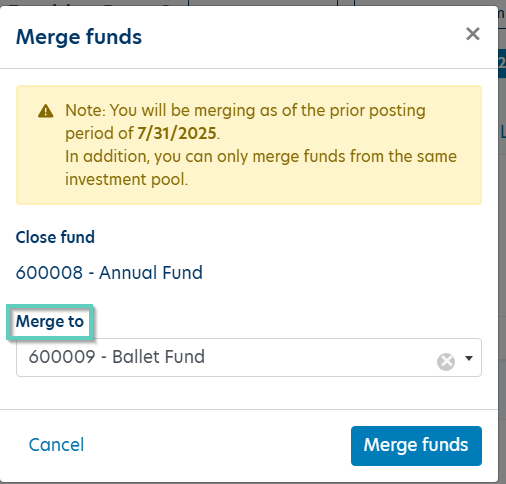

- Funds must be in the same investment pool to be merged.

- Merging occurs as of the prior posting period. If your organization is using an End-of-Month pricing model, we recommend deactivating the fund and transferring the balance to an existing fund, instead of the Merge Funds function.

- If your merged fund is assigned to a Percent Average spending rule, Balance will take the merged fund's history and include it in the spending calculation for the new fund. This will capture the combined Market Value for average values needed to determine spending.

Instructions on how to deactivate and transfer a fund balance can be found here: How Do I Close a Fund?

This article explains the differences between merging and closing a fund: Should I Close or Merge a Fund?

How to Merge Funds

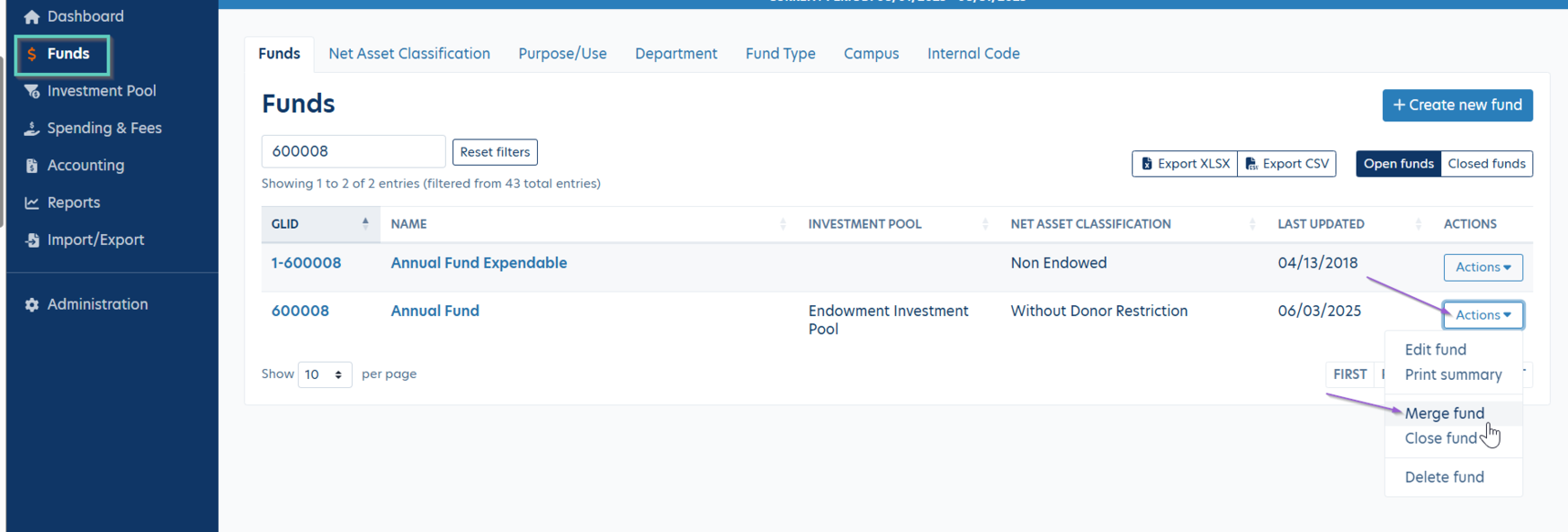

- Navigate to Funds on the left side panel in your database and locate the fund you'd like to close.

- Click 'Actions' next to the fund then select 'Merge fund'. If you've already clicked into the Fund profile, simply click the 'Fund actions' button in the top right corner the select 'Merge fund'.

- Enter the Fund into which the fund will be merged to. The merge will occur as of your last posting period.

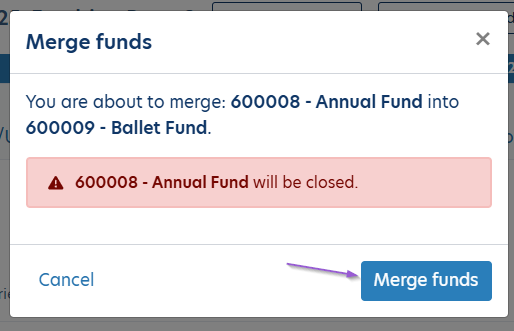

- Click 'Merge Funds'. The system will send a reminder/warning of the fund that will be closed before actually merging funds.

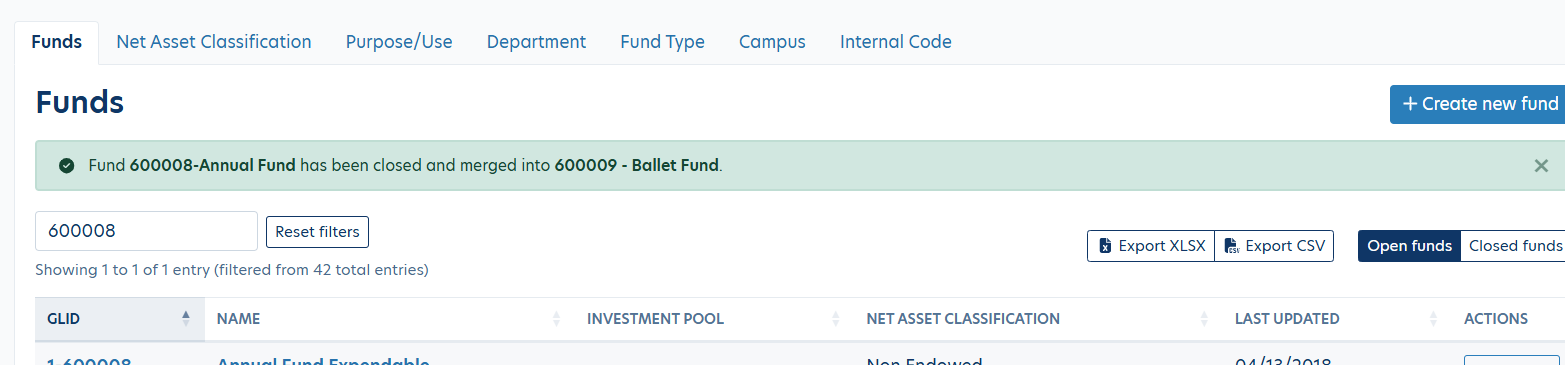

- Click 'Merge Funds' once more. Balance will note that the fund is now closed and merged into another fund.

Once a fund is merged, Balance will automatically create system-generated transactions to move the historical gift and market value balances (i.e. earnings) to the remaining open fund.

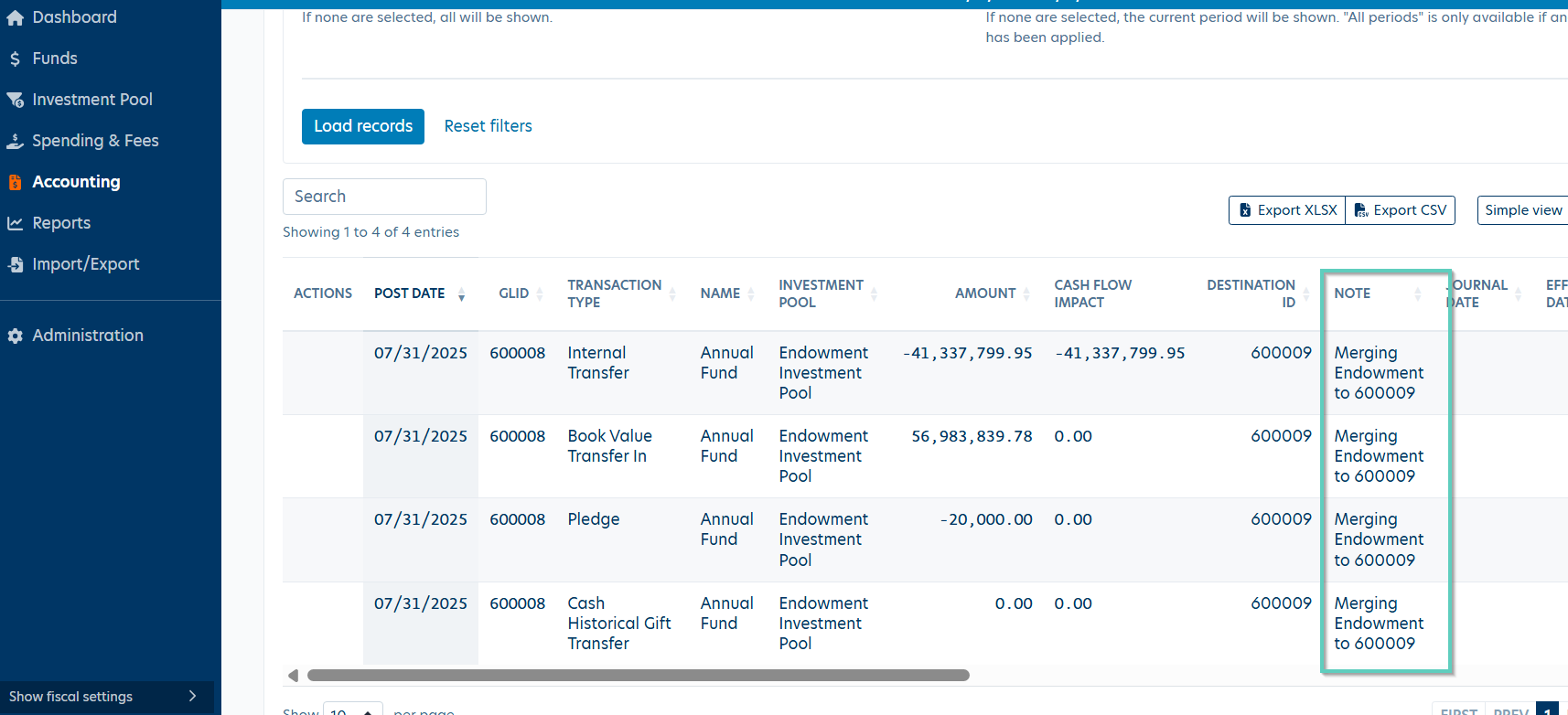

To view the transactions created, the period needs to be closed. Then you can navigate to Accounting and use the parameters to filter the activity to view, then click 'Load records' button. The transactions created by Balance will include a note of "Merging Endowment to XXX."

Notes

- Users are not able to delete or modify the system-generated transactions that are produced from merging a fund.

- If a merged fund needs to be re-opened, you'll need to re-open to the period in which the fund was closed. By doing so, the system-generated transactions will be deleted, reestablishing the fund's balances.

Redirecting Distributions from Merged Fund

If applicable, be sure to follow the steps below to redirect the distributions that may be generated by the closed (merged) fund:

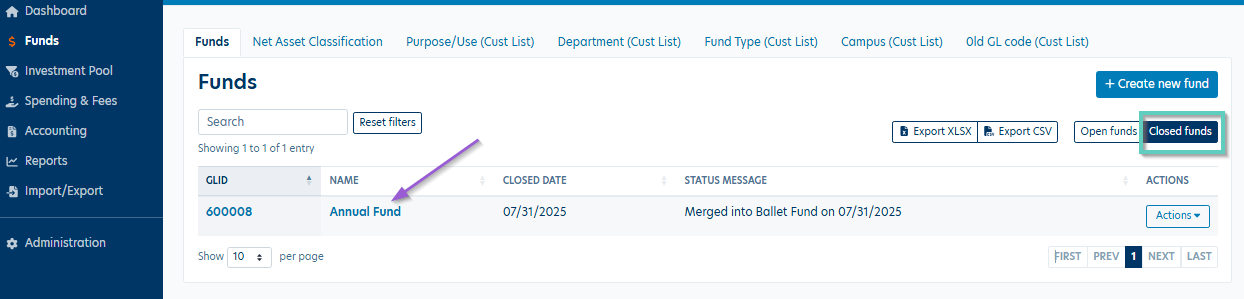

- A Distribution Rule needs to be set up on the fund that is being closed (either prior to or after fund closure, but before creating distributions). To add a Distribution Rule, navigate to Funds and click the Closed Funds tab then select the closed fund from the list.

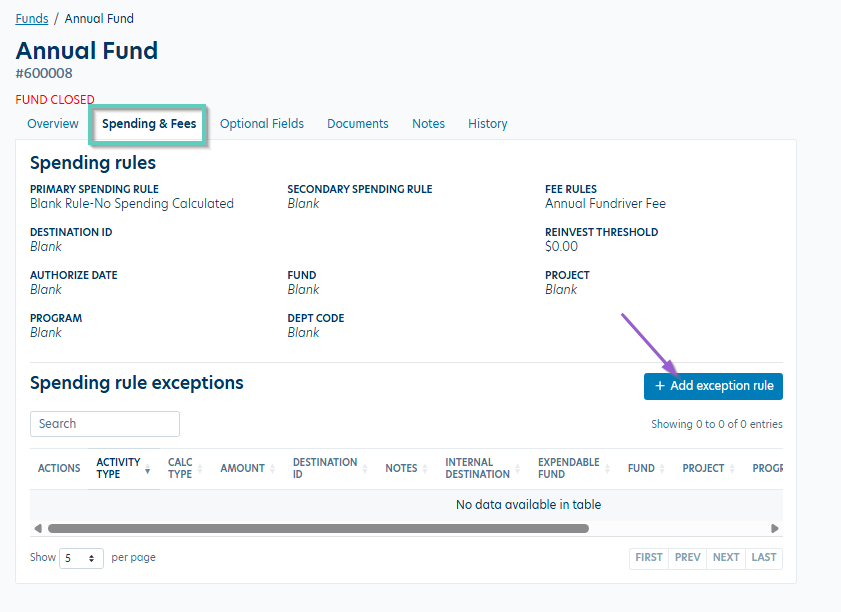

- Navigate to the Spending & Fees tab in the fund profile. Under Spending rule exceptions, click the blue 'Add exception rule' button.

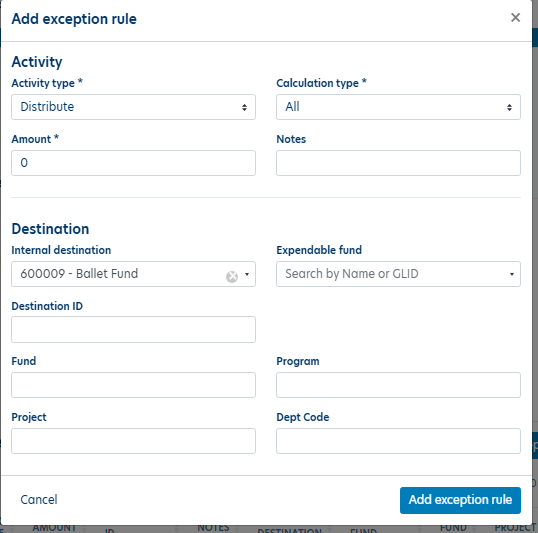

- Set the Activity type to Distribute, Calculation type to All, and set Amount as 0. The Internal Destination should have the name of the fund into which the closed fund has been merged. If your organization utilizes a GL Export for distributions, the Destination ID, Fund, Program, and Project should mimic what is set up on the internal destination fund.

Note: It may be helpful to take a screen shot of the destination fund for your reference during this process.

In cases where the Destination, Fund, Project, etc. are already the same (due to a previously setup Distribution Rule), then only the Internal Destination needs to be modified.

Once the Distribution Rule is set up for all funds being merged, distributions can be generated by navigating to Spending & Fees then clicking 'Distribute spending'.

Reply

Content aside

- 6 mths agoLast active

- 68Views

-

1

Following