How Do I Close or Delete a Fund?

The steps outlined below are for closing and deleting funds in Balance.

Deleting a Fund

Funds can only be deleted if there is no activity or history posted for the fund, and it was created in the current open period. If you get an error message when attempting to delete a fund, it cannot be deleted and we recommend closing the fund instead.

- Navigate to Funds on the left side panel in your database. Use the search box to locate the fund you want to delete.

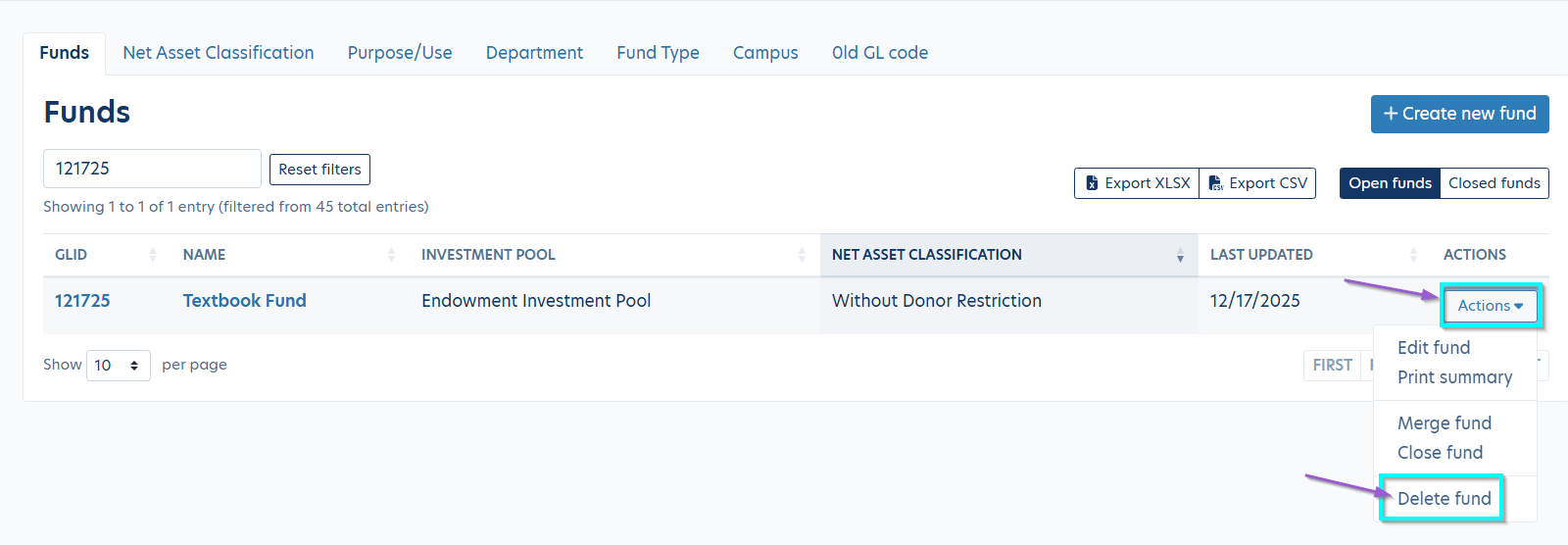

- Click the 'Actions' button next to the fund and select 'Delete fund'.

- A pop-up will appear asking you to confirm the deletion. Click 'Yes, delete fund' to continue.

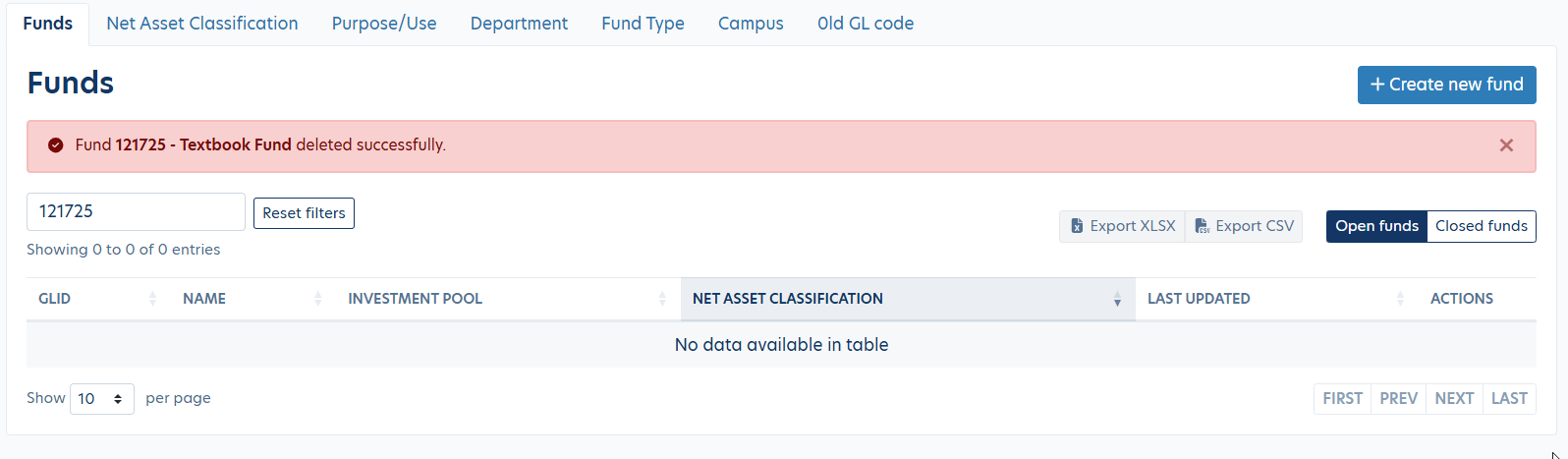

- A red banner will appear confirming that the fund has been deleted.

Closing a Fund

To close/deactivate a fund, follow the steps below and Balance will generate the entries to close out the fund's market value, historical gift, and units.

Note: If you have pending transactions within the period that you are closing a fund, then Balance will NOT allow you to close the fund.

Navigate to Funds on the left side panel in your database. Select the fund you'd like to close.

Click 'Fund Actions' in the top right corner, then select 'Close fund'. A pop-up window will ask you to confirm that you want to close the fund, hit 'Close fund' to confirm.

- You'll then see a green banner confirming that the fund has been closed, and 'FUND CLOSED' will appear on the fund page as well. Once the period is closed, the fund will be closed too.

- If you have pending transactions posted to the fund, Fundriver will not allow you to deactivate the fund. You'll see the red banner as shown below:

To continue closing the fund, you must do one of the following:

- Delete the current period transaction(s) on the fund (do so by going to Accounting> Fund Activity and searching for the fund).

OR - Deactivate the fund in the subsequent period.

- Delete the current period transaction(s) on the fund (do so by going to Accounting> Fund Activity and searching for the fund).

- Once a fund is closed, Balance will automatically create system generated transactions to sell units, to zero out the market value, and to zero out the historical gift of the fund as of the prior period value. The transactions created by Balance will include a note of "Closing Endowment." Closing a fund will create cash flow in the investment pool reconciliation.

You can view these system generated transactions by navigating to Accounting, entering in the Fund then hitting 'Load records'.

You'll see the following transactions have been created:

- Non-Unitized Asset Transfer: This will generate for the total amount of non-unitized assets associated with this fund as of the last closed period. This impacts total market value but does not impact pooled market value.

- Internal Transfer: This will generate for the difference between the Market Value and the Historical Gift amount of the fund as of the last closed period. This impacts total market value, pooled market value, and book value.

- Cash Historical Gift Transfer: This will generate for the Historical Gift amount of the fund as of the last closed period. This impacts total market value, pooled market value, book value, and historical gift.

- Book Value Transfer Out: This will generate for the difference between the Market Value and the Book Value amount of the fund as of the last closed period. This impacts only book value.

Note: You cannot edit the transaction type or amount for these transactions. You can however edit the Journal date and Notes if desired.

Note: You cannot delete the system-generated transactions that are produced from closing a fund. If these entries need to be deleted, simply re-open the fund (see steps below). When a fund is re-opened, the system generated closing entries are erased.

Profile information for the deactivated fund will still be stored in your database for historical purposes.

If you are deactivating an Expendable Fund, Balance will automatically generate the necessary transactions to close the fund and these transactions will have no impact on your Endowed Pool reconciliation. The Expendable Fund will close once your Investment Activity is entered, and your current posting period is closed.

Transferring the Historical Gift and Market Value to Another Fund

These steps are for users that have closed a fund and want to transfer the historical gift and market value to another fund. Two entries will be required - one to move the historical gift balance and one to move the appreciation/depreciation of the fund. If you also track Book Value, a third transaction will be needed.

Note: We recommend taking a screenshot of the Fund activity screen to get the amounts needed for the following transactions. Navigate to Accounting, enter the fund you want to view, and you'll see 4 new transactions that were created when closing the fund.

- Navigate to Accounting, select 'Add transaction' button.

- Enter the fund that will be receiving the value. Select 'Cash Historical Gift Transfer' as the transaction type. This will transfer the historical gift value of the fund.

- Enter the Cash historical gift transfer amount from the fund activity screen.

Record as a positive number if moving to a new/existing fund. - Click 'Add activity' to save the transaction.

- Click the ''Add transaction' button again to create the second transaction. Enter the fund that will be receiving the value again.

- Select 'External Transfer In' as the transaction type. This will transfer the appreciation/depreciation of the fund.

- Enter the Internal Transfer amount from the fund activity history screen, but record with the opposite sign. For example, if the Internal Transfer amount out of the closed fund was $100, you'll enter -100 for this transaction.

- Click 'Add activity' to save the transaction.

Optional: If your organization also tracks Book Value, follow these steps as well:

- Click the 'Add transaction' button again to create a third transaction. Enter the fund that will be receiving the value again.

- Select 'Book Value Transfer In' as the transaction type.

- Enter the amount from the fund activity history screen with the same sign. So if the Book Value Transfer Out was a negative, you'll enter as a negative, and vice-versa.

Clear Out Balances WITHOUT Closing The Fund

These steps are for users that are not closing a fund but want to clear out the balances. Two entries will be required - one to move the historical gift balance and one to move the appreciation/depreciation of the fund.

Note: If your organization utilizes an end of the month pricing model, the fund will still receive an earnings allocation while it is active/open. Therefore once the period is closed, the fund will no longer have a zero balance.

- Navigate to Accounting, select 'Add transaction' button.

- Enter the fund that will be cleared out. Select 'Cash Historical Gift Transfer' as the transaction type. This will transfer the historical gift value of the fund.

- Enter the Cash historical gift transfer amount. Record as a negative number if you are clearing out the historical gift value without closing the fund. You can find this amount on the Fund's Profile page.

- Click 'Add activity' to save the transaction.

- Click the ''Add transaction' button again to create the second transaction. Enter the fund that will be cleared out again.

- Select 'External Transfer Out' as the transaction type. This will transfer the appreciation/depreciation of the fund.

- Enter the difference between market value and historical gift.

- Click 'Add activity' to save the transaction.

Optional: If your organization also tracks Book Value, follow these steps as well:

- Click the 'Add transaction' button again to create a third transaction. Select the fund that will be cleared out.

- Select 'Book Value Transfer Out' as the transaction type.

- Enter the book value of the fund. This can be found on the Book Value Report in the Summary folder.

Reopening a Fund

If needed, you can re-open a fund on the Fund page by clicking the 'Fund actions' button and selecting 'Reopen fund'. The system generated transactions associated with the closing will be deleted.

Reply

Content aside

- 1 yr agoLast active

- 587Views

-

1

Following