How Do I Set Up a Spending Rule?

Spending Rules dictate how earnings on an endowment can be spent. Spending Rules are typically based upon an organization’s spending policy. Organizations may apply one Spending Rule to all of their endowment funds or assign different rules to groups of funds.

Note: A customer should have distributions impacting units (default) when implementing multiple Spending Rules within the same pool. Adjusting unit price only works well with the Percent to average of the Pool spending rule and there are no spending exceptions or supplemental distributions. For more info, see Distributions - Selling Units vs. Impacting Pool Price

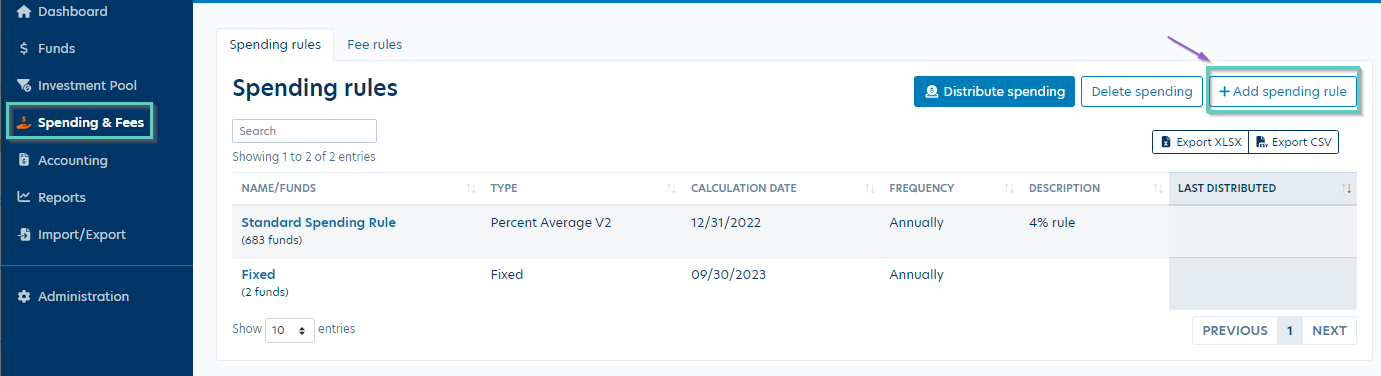

Navigate to Spending & Fees in the left panel then click 'Add spending rule' button.

Name your Spending Rule, enter a brief description and chose the spending rule type. Spending rule type is a required field, even if it’s a Blank Rule. See below for more information on Spending Rule Types.

Spending Rule Types

Blank Rule

Nothing is calculated. All funds are required to have a Spending Rule even if they do not calculate spending. ‘Due To/Due From’ funds often are assigned to Blank Spending Rules (as are funds that do not spend).

Dollar Amount Per Unit

The spending amount is calculated as the number of units a fund holds in the pool multiplied by the rate entered into the Spending Rule. This is more commonly used by larger organizations. In most cases, spending distributions need to impact unit price (not the number of units) and all funds need to take a distribution.

Fixed

When a fund is required to post a fixed dollar amount of distributions (i.e., $1,000 per year), the fund must be assigned to this Spending Rule. Note: If you are looking to add a fixed dollar amount to an individual fund, you would do so by assigning to this Spending Rule and then adding a Spending Rule Exception. See this article for further instruction - reference example #4 in that article for fixed distributions rule set up.

Osher

Gift agreements received with Osher Lifelong Learning grants set specific spending parameters for how Osher funds should be managed and spent. Balance accounts for these gifts through the use of a standard Osher Spending Rule; the minimum amount of spend each year will be 50% of the investment earnings, net of investment fees, determined once per year, based on the average rate of return for the 12 calendar quarters preceding the determination date (or if less, the number of complete quarters the Osher Endowment has been held), but in no event less than an amount equal to 5% of the invested principal amount as of the beginning of Grantees’ prior fiscal year. The spending calculation for the Osher rule can be previewed through the Spending Allocation Report for Osher Life Long Learning report. This report is located in the Spending folder under Reports.

Percent Average

The Percent Average Spending Rule is the most common rule used. It can be configured to calculate spending distributions based upon the rolling average of either the fund’s value, the pool value, or unit price. This rule will include the history of a merged fund when calculating the spend amount. View this article for instructions on how to merge funds.

Percent of Income

This is rarely used. It is designed for funds that can only distribute income or realized gains. This is to support funds following pre-UMIFA guidelines.

Prior Year Spending

This rule calculates an increase from the prior year’s spending plus a percent of any new gifts. (Less common.)

Proportional Distribution

This rule distributes a fixed amount across all funds assigned to the rule based upon the units that the fund holds in the pool. NOTE: If a fund that participates in this rule does not participate in spending, the total may not add up to the amount entered. There may also be rounding issues causing the total distribution to be off a few pennies. This rule can be used when spending impacts units or unit price.

Yale Method

This rule is a blend of the average market value and prior year spending rules. It can be configured in Balance to calculate at the fund or pool level. The system default is calculated based on the pool level.

Spending Calculation fields (depending on spending rule type):

Distribute Spending Frequency

How often does your organization post spending distributions to your general ledger? Options are: Monthly, Quarterly, Semi-Annual and Annual.

Transaction Type

If your organization utilizes custom transaction types, you’ll be able to select a Transaction Type other than Distribution. If you need a custom transaction type, please reach out to Balance Support.

Calculation Date

“As Of Date” or “Look Back Date” that your funds are valued at for your spending policy calculation. For example: if your policy uses a 12-month rolling average starting at 12/31/2022. The 12-month period would look back from the calculation Date (12/31/2022).

Note: The fields and descriptions listed below for Spending Calculation Parameters are based on the Percent Average Spending Rule Type. The spending calculation parameters will differ based on Spending Rule Type.

Avg of

Description of each option is below

Percent to Distribute

Enter a whole number. For example, 5% should be entered as “5” not “.05”. Enter the annual rate for spending.

Number of periods

If the rule is trailing 3 years using quarterly values, then enter 12. If the rule says trailing 3 years using annual values then enter 3.

Period Length

Options for averaging are Monthly, Quarterly, Annual, Semi-annually.

Fixed Periods (check box)

Does your organization average all available quarters? Or only available averages? The example below shows a fund that was created in March 2016. When the average of fixed periods box is checked, Balance would add zeros for the periods where no value was available. Leave the box unchecked would average only available fund values.

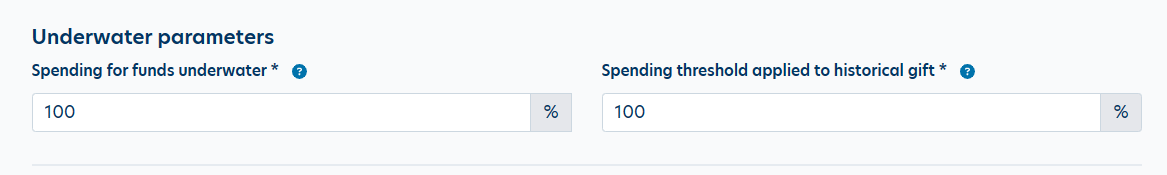

Underwater Parameters

Spending for funds underwater

This setting determines if an Underwater fund (i.e., Market Value is less than Historical Gift/Corpus) can participate in spending.

You would enter the amount as a full number. Enter 0 if the fund is not permitted to spend when underwater. Enter 100 if a fund can participate in spending if it’s underwater. If a fund is allowed to take 90% of the calculation if underwater, then enter 90, etc.

Underwater Calculation Date: When setting up Underwater parameters in a spending rule, the system will calculate the underwater status as of the calculation date in the spending rule parameters. When running the Estimated Spend Report, the underwater status will also be based on the same calculation date, regardless of what post date you put in the report parameters. If you use a current post date, the system will display current market values/historical gift as purely informational, but won’t factor into the spending/reinvestment columns status as of the post date. When distributions are actually created, the system will look at the post date values to determine Underwater status.

Spending threshold applied to historical gift

This setting limits how far the Historical Gift/Corpus of an Underwater fund can be invaded. By entering a percentage greater than 100% this keeps an additional buffer greater than corpus. If entering a lower percentage below 100% this allows a fund to spend down into corpus based on a percentage vs. limiting to an amount over historical gift or not at all.

In the images below, the customer has a 102% HG Threshold, therefore the allowed amount to spend is the difference between the Market Value and 102% of Historical Gift value.

This is how the set up for the above scenario would look in the spending rule Underwater Parameters:

If spending is allowed on funds into 10% of Historical Gift/Corpus, the setup would be as follows:

Additional Fund Level Processing

Automatic Reinvestment for Funds with Thresholds (check box)

Check this box if you would like for funds that have not yet met their associated "Reinvest Threshold" or "Authorize Date" to reinvest the calculated amount. Note that if spending adjusts unit price, we recommend this option by chosen.

Limit Spending to Prevent Underwater Status (check box)

Check this box to allow spending up to the point that the fund would go underwater, therefore preserving the Historical Gift/Corpus. Note the "Spending for funds underwater" must be set to "0".

Automatic Reinvestment for Funds Underwater (check box)

Check this box if you want underwater funds that are not allowed to spend to reinvest the calculated spend amount. Distributions and reinvestment transaction will be posted, netting to zero. Based on client settings, the reinvestment will increase either the historical gift or market value of the fund.

- Example: A fund has a historical gift value of $100,000. The market value of the fund as of the spending calculation date is $95,000. This fund is underwater; MV < HG. The spending policy determines that $2,500 would be available to spend if there were no underwater limitations. Checking the Automatic Reinvestment for funds underwater check box will post a distribution of $2,500 and a matching external transfer in (or income to principal- depending on customer setup). The two transactions net to zero. Leaving the box unchecked will show no available spend on the spending reports and no transactions will be posted.

- Note: If you are using the average of the POOL, you will need to check the Auto Reinvest box as well. This rule assumes everyone gets a distribution at the same rate, so you have to Distribute, then Reinvest for the total spend amount to work properly. You have to auto-reinvest the calculated amount (even if it’s underwater) so that all funds get a distribution at the same rate.

- Customer databases that have distributions programmed to impact unit price will need to have this box checked as well.

Save your new Spending Rule

Once you have selected your Spending Rule and applied applicable parameters, click 'Create rule'.

A message will appear confirming your rule was successfully saved.

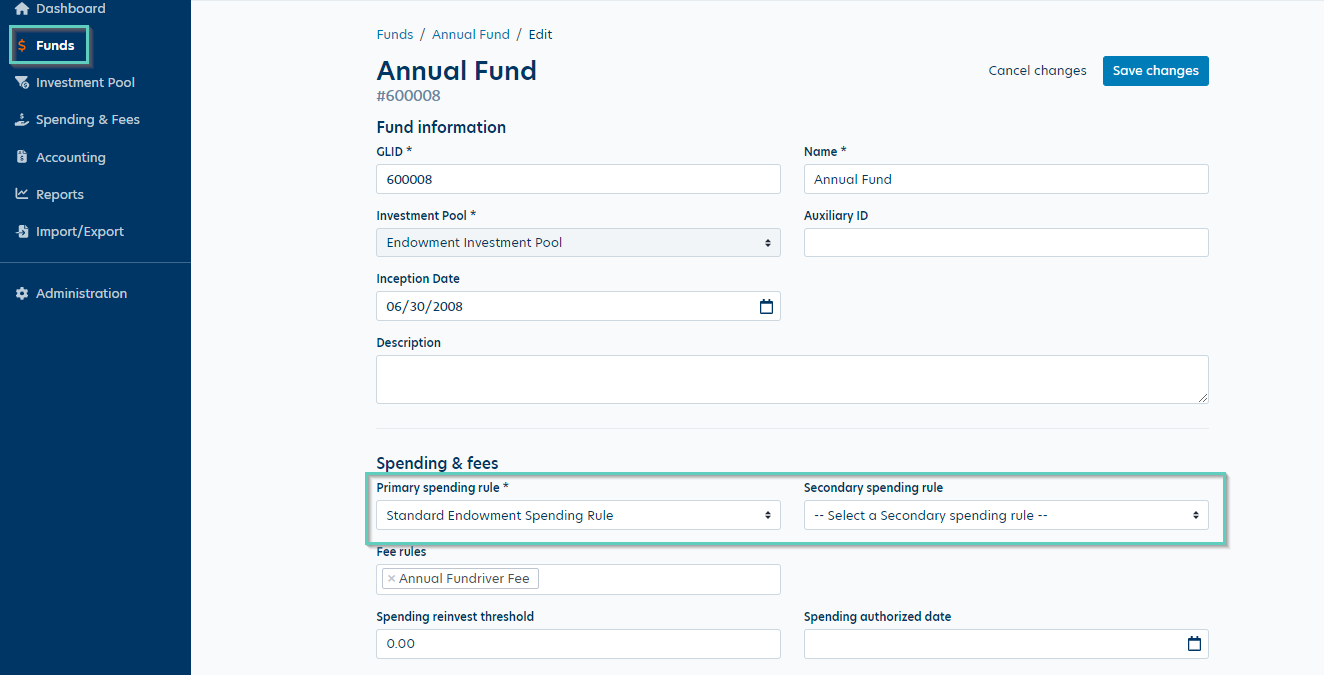

Add a Secondary Spending Rule (if needed)

You have the option to add a Secondary Spending Rule. An example of this would be if the standard spending policy is 5% but the fund is allowed to spend an additional 3%; that 3% would be set up as the Secondary Rule. Set up the same method as adding a primary rule and then assign within the secondary spending rule field on fund profile.

Assign Primary and Secondary Spending Rules

Manual Method

You can assign funds to a specific spending rule on the Fund Profile. Navigate to Funds on the left panel in your database, then select the fund to assign. Hit the 'Fund actions' button in the top right corner, then Edit fund. You'll be able to select any existing spending rule in both the Primary spending rule and Secondary spending rule fields.

Import Method

You can also use an import template to assign spending rules to funds in bulk. See this article for steps: Adding/Changing Funds in Bulk

Estimated Spending Report

When the Spending Rule and fund assignments are completed, you may preview the estimated spending amounts by viewing the Estimated Spending Report (with Column Grouping and Drill Down). This report is located in the Spending folder under Reports.

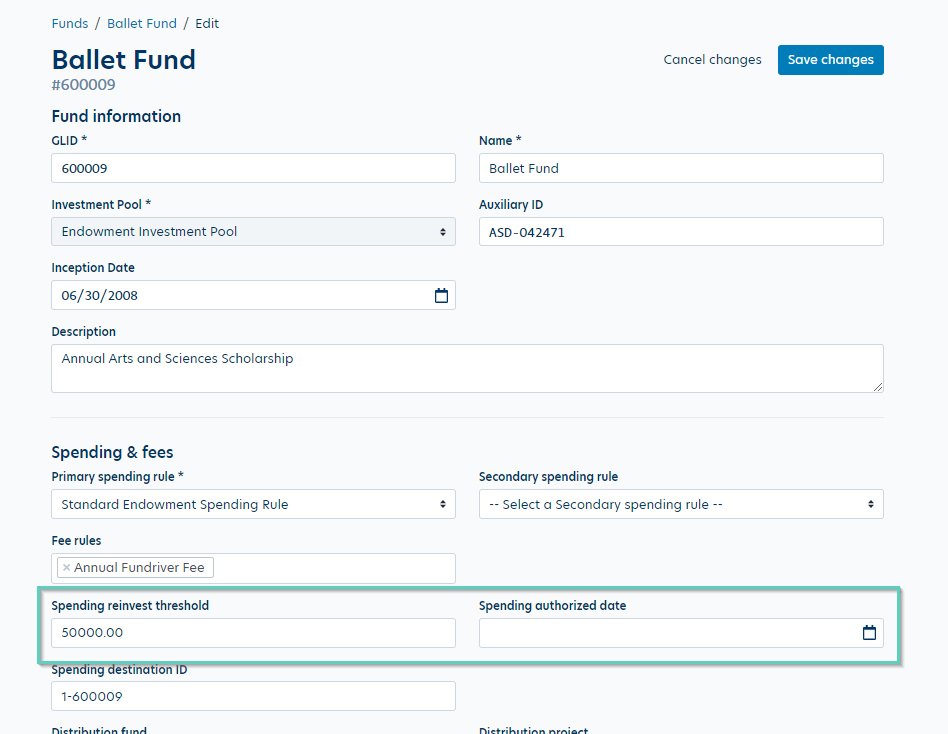

Assign Optional Spending Criteria by Fund

We have a few options that can be added to the spending rules specific to funds. Please see the Funds tab to add these.

Spending Thresholds

Spending Thresholds can be added by fund. By default, only one condition needs to be met to allow spending (either Reinvest Threshold or Authorized Date). To apply these thresholds, navigate to Funds, select a fund, then hit the 'Fund actions' button in the top right corner, then 'Edit fund'. You'll fill in either the reinvest threshold or authorized date, then click 'Save changes' at the bottom of the page.

The Reinvest Threshold looks at a fund’s historical gift value as of the Spending Rule Calculation Date.

The Authorized Date is compared to the current posting period date.

These thresholds, either individually or in combination, are used to determine if a fund has met the condition and is allowed to spend. If a fund has not met the threshold conditions, it will reinvest the calculated spend back to principal (historical gift).

Notes on Spending Thresholds:

- If you want to have the Reinvest Threshold look at Market Value instead of Historical Gift, please reach out to Balance Support to have this setting changed.

- If you want the Authorized Date to use the spending rule’s Calculation Date instead of the Current Posting Period, please reach out to Balance Support to have this setting changed.

- If you want to apply both a Reinvest Threshold and a Authorize date, please reach out to Balance Support.

- Both the Historical Gift or Market Value thresholds are not a one-time condition and will prohibit spending if the values dip below the thresholds. The Authorized Date threshold looks at a Post Date in the future that the fund must have been in place to participate in spending. By default, only one condition needs to be met to allow spending. If both a date and dollar threshold are populated and you want BOTH conditions to be met, please reach out to Balance Support to have this setting adjusted.

Spending Rule Exceptions

Spending rule exceptions (distribution rules) can be added by navigating to Funds> Spending & Fees. Check out this article for instructions.

Reply

Content aside

- 1 yr agoLast active

- 617Views

-

1

Following